Whole Life Insurance

Protect your family for as long as you live.

Whole Life Insurance From Family Legacy Protection!

Whole Life Insurance offers lifelong protection, but it can do much more. Whole life insurance can give you:

Lifelong coverage to protect your family from financial loss

Level payments that are guaranteed to never change

A guaranteed death benefit

An option to build cash value

WHAT IS WHOLE LIFE INSURANCE?

Whole life insurance is a type of permanent life insurance. It’s also the most common, according to the Insurance Information Institute. Like most permanent life insurance policies, whole life offers a savings component, called “cash value,” and life-long protection — as long as premiums are paid, whole life provides a death benefit after you die.

WHAT ARE THE BENEFITS OF WHOLE LIFE INSURANCE?

Certain aspects of whole life insurance can make it an appealing choice.

Your premiums and death benefit are fixed.

You can withdraw funds or take out a loan.

You have a guaranteed rate of return.

FIXED PREMIUMS AND DEATH BENEFIT

In most cases, the premium and death benefit stay constant for the duration of a whole life policy. (A universal life insurance policy, on the other hand, may offer the option to adjust your premiums or death benefit.)

With fixed premiums and a fixed death benefit, you won’t have to worry about cost increases as you get older, and your loved ones will know the amount of life insurance proceeds to expect when you do pass on.

CASH VALUE

A whole life policy can serve as a source of emergency funds for you if something goes wrong; you are able to take out a loan against the policies death benefit. That’s because a portion of each of your premium payments is funneled into a savings component of the policy called the “cash value.”

Over time, the cash value builds, and you’re able to withdraw funds or borrow against it. The rules on how and when you can do that vary by company and policy. There are guidelines to follow, so that you don’t inadvertently reduce the death benefit or create a tax burden. In addition, The cash value of a whole life policy is guaranteed to earn a minimum amount of interest.

Frequently Asked Questions

HOW MUCH DOES WHOLE LIFE INSURANCE COST?

The cost of a whole life insurance policy depends on several factors, including how much coverage you buy. Additionally, factors such as your age, health and life expectancy may affect the premiums you pay for whole life.

When it comes to paying your premiums, you’ll typically be able to make an annual payment for a whole life insurance policy. Some insurers may also offer the option to pay monthly, quarterly or bi-annually.

WHO MIGHT CHOOSE WHOLE LIFE INSURANCE?

So, when might a whole life policy make sense for you?

A whole life insurance policy might be a fit for someone who likes predictability over time, since whole life offers death benefit guarantees, guaranteed rates of return and fixed premiums. You will want to talk it over with a Priority Life agent and review other options before you make any decisions. That way, you can be confident you’ve chosen the life insurance policy that’s suited just for you.

ARE WHOLE LIFE INSURANCE PREMIUMS TAX DEDUCTIBLE?

According to the Internal Revenue Service (IRS), you cannot deduct premiums you paid for a whole life insurance policy on your tax return.

However, if your beneficiaries receive the death benefit from your whole life policy, they likely would not have to pay federal income taxes on that benefit. (But, any interest earned on top of the death benefit is considered taxable income.)

IS WHOLE LIFE INSURANCE MORE EXPENSIVE THAN TERM INSURANCE?

In most instances yes, whole life is more expensive than term life. The reason why is guaranteed to pay a death benefit as long as the policy stays in force (usually depending on premiums being paid). Term insurance is not guaranteed to pay out and expires when the term is up. Additionally term insurance does not build cash value you can access.

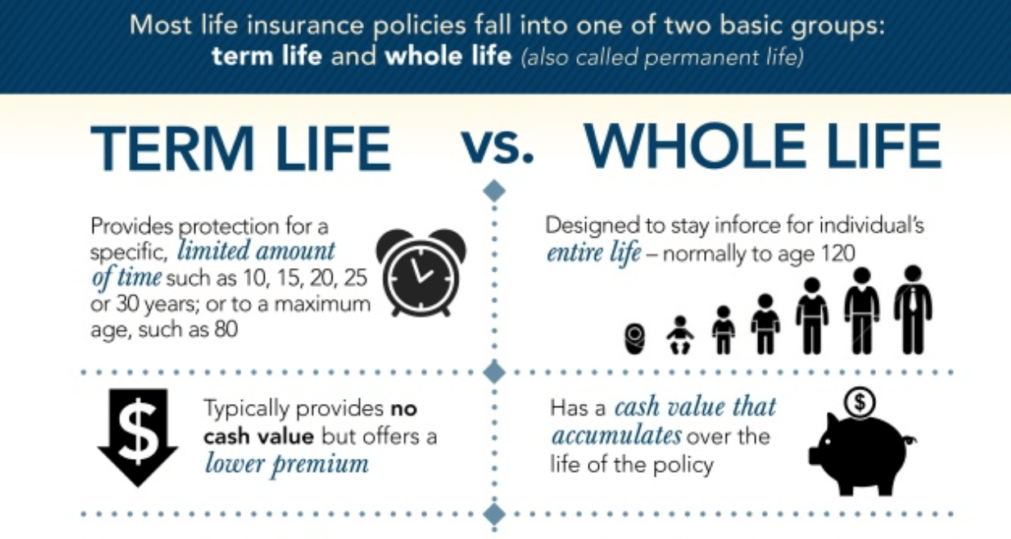

Term vs Whole Life

It’s important to understand the differences between Whole Life Insurance vs Term Life Insurance. As you can see pictured above, Term Life lasts a certain amount of time; typically 10, 15, 20, 25 or 30 years – depending on your age.

Whole life, on the other hand, lasts your entire life. It never expires and the price never changes. It can accumulate a cash value that you can use as a “loan” to yourself. More commonly it is used to make the payments on your behalf so you don’t have to, later down the line.

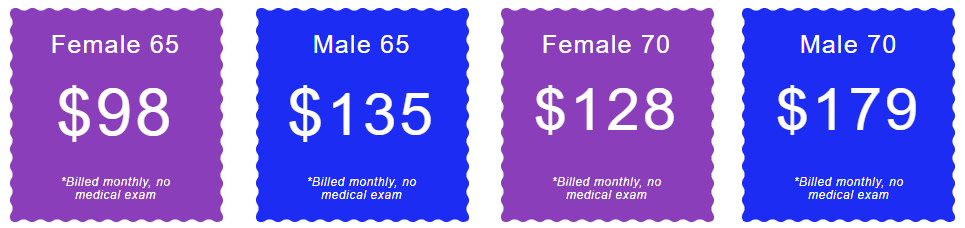

Example: Cost of $25,000 Whole Life Insurance in Rhode Island

*Please note that these rates are only examples for informational use only so you can see the price range of a typical Whole Life Insurance Policy. For the exact price for you please click the button below.

Above, you can see a cost estimate for a $25,000 whole life policy in Rhode Island. This would be for what is known as a Standard Issued Policy. This means you are approximately average health. However, if you have had major health concerns such as cancer, COPD or Alzheimers, you can still get whole life insurance. Below you will find the estimated cost of life insurance that is guaranteed issue. This means, no matter what your health is, you are guaranteed to get a policy. The only caveat is that there is usually a 2 year decreased pay period.

If you pass away, within those first two years, the insurance company will refund all the money you paid into the policy to your beneficiary plus 10% interest. Once you reach the 24-month mark, your policy is exactly the same as a normal, standard, whole life insurance policy.

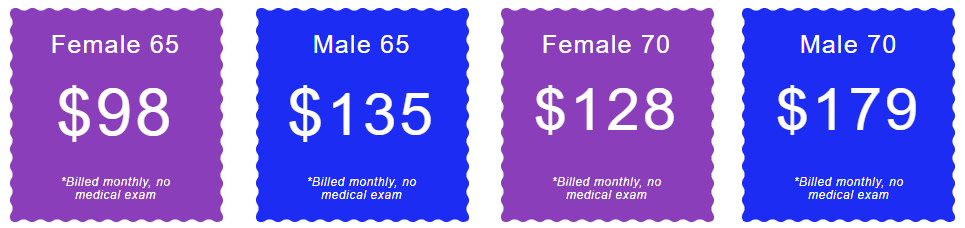

Example: Cost of Guaranteed Issue $15,000 Whole Life Insurance in Rhode Island

As you can see, the Guaranteed Issue Policy costs more. That is because the insurance company is taking on greater risk and therefore the cost will be slightly higher.

Also note: If you develop a Chronic, Critical, or Terminal Illness, you may receive 75-100% of your policy amount while you are still alive. This is called a living benefit.

Talk to a State Licensed Insurance Broker today to see which policy you qualify for.